What is guaranteed life insurance? It’s coverage that even the sickest people qualify for. The last thing people who are ill want to talk about is life insurance. But sadly, for some, this is often the only time this topic comes up.

Whether you’ve been denied traditional coverage, have a serious diagnosis, or just don’t want to deal with medical exams and forms, guaranteed coverage offers a way forward.

My guess is that if you’re reading this post, chances are you’re trying to figure out if this type of policy is the safety net you need.

At TermCanada, we work with clients in this exact position. So let’s walk through what guaranteed life insurance really is, how it works, and whether it’s the right fit for your situation.

Note: For this coverage, you’re approved with no medical exam, no questions, and no labs. These policies are created for older Canadians with serious health conditions who may not qualify for traditional or even simplified issue life insurance. Even if you’ve been declined, this is the most accessible form of protection available, and for the right person, it offers peace of mind.

Learn how guaranteed issue fits into the broader life insurance landscape in Canada.

Why Some Canadians Choose Guaranteed Life Insurance

I am sure you’ve seen the ads: “No Medical Exam Required!” or “Guaranteed Approval!” BUT… is it really that easy? Well…yes and no.

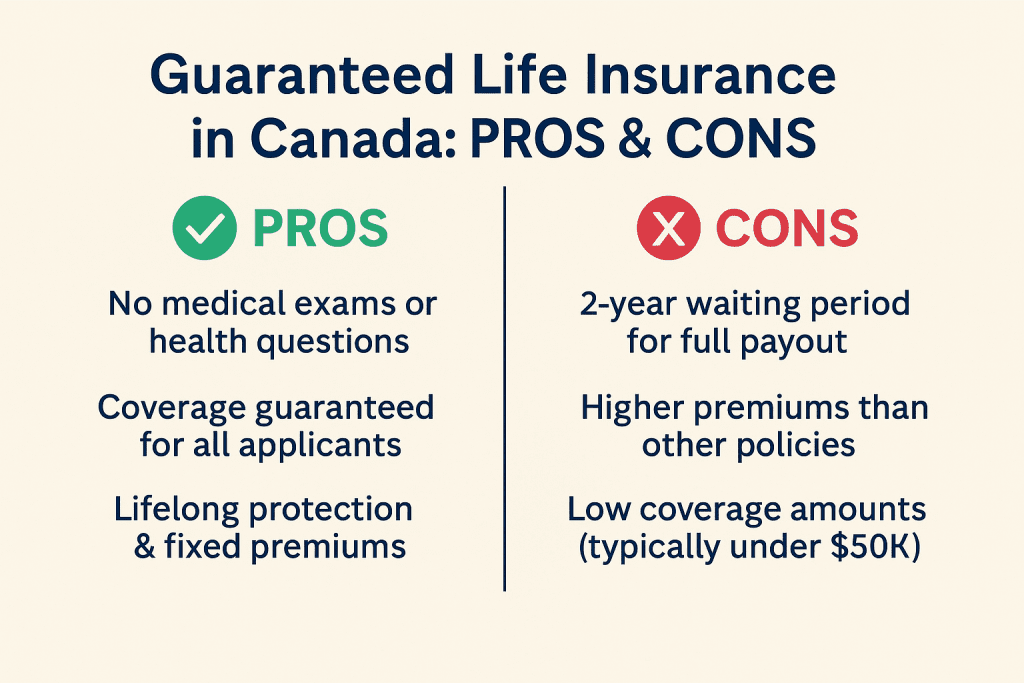

The appeal is clear. You don’t need to go through a medical exam or health questions. Premiums are fixed and won’t increase over time. Your coverage lasts for your entire life, and the application process is remarkably simple. If you’re someone who’s been told “no” by other insurers, or you’re facing a new medical diagnosis and want to protect your loved ones, this feels like a lifeline.

However, there are things you should know before jumping in.

Buyer beware. If you die before the end of your two-year waiting period (and all guaranteed products are subject to that), your beneficiary receives a refund of the premiums you paid, with some interest.

For many people, this is a deal-breaker. But it depends on your situation. At TermCanada , we always give you the full picture. For example, one of our clients was recently diagnosed with terminal cancer. He understood the waiting period and still took out a policy. He said, “If I live past two years, my wife gets the full payout. If I don’t, she still gets the money I paid plus some. Either way, I’m doing something to help her.”

Sometimes, having a plan in place is better than doing nothing at all.

Coverage Amounts: What to Expect

Guaranteed life insurance is designed for final expense planning. That means the death benefit is typically smaller, from $5,000 up to about $50,000. You won’t find million-dollar coverage here, and that’s intentional. These policies are meant to cover funeral costs, pay off small personal debts, leave a gift for loved ones, and help with probate or legal fees. If you’re trying to leave behind a substantial estate or replace income, this isn’t the right type of policy. But if your goal is to make sure your passing doesn’t create a financial burden, this is exactly what you need.

Who Is Guaranteed Life Insurance For?

Let’s cut to the chase. This kind of policy isn’t for everyone. While guaranteed life insurance in Canada offers peace of mind for some, it’s designed for very specific situations. It’s best for seniors who no longer qualify for traditional coverage, Canadians with serious or terminal health conditions, and those who have already been declined. It’s also a practical option for individuals who prefer not to deal with the medical exams, paperwork, or delays associated with underwritten policies.

If time, health, or complexity are barriers, this product was created for you.

But what if you’re still in decent health?

In that case, guaranteed coverage shouldn’t be your first stop. People in relatively good health, especially non-smokers under age 70, can often qualify for more robust policies, such as simplified issue or fully underwritten term life insurance. These options usually come with lower premiums, higher coverage amounts, and shorter or no waiting periods.

At TermCanada, we don’t push one-size-fits-all solutions. That’s why it’s important to speak with an independent broker. We discuss your current health status, your urgency for coverage, and your future plans.

From there, we explore all available options. A guaranteed policy only comes up if it’s truly the best fit. Either way, we’re here to make sure you’re not making that decision alone

How Much Does It Cost

Because there’s no health screening, insurance companies take on more risk, which means higher premiums. Expect to pay more per dollar of coverage compared to term life insurance or even simplified issue plans. It’s not the cheapest option, but for some Canadians, it’s the only option.

True Story: When Guaranteed Life Insurance Makes Sense

One of our clients, let’s call him Michael, was 68 and recently diagnosed with a serious illness. Traditional insurers turned him down flat. He came to us wondering if there was any way he could still protect his wife financially.

We walked him through his options. He didn’t love the idea of a two-year waiting period and opted out of the coverage. Michael ended up living well past the two-year waiting period and regretted not pulling the trigger when he could have.

He talked about getting coverage, but never signed on.

They were not a wealthy family, and that policy would have made all the difference in the world.

Compare and contrast this situation with the one I mentioned above, where the client viewed his guaranteed issue policy as an opportunity to save money at worst and as much-needed coverage at best.

Two very different outcomes.

TermCanada Tip: Replacing Guaranteed Coverage Later

Here’s something many people don’t realize. You’re not locked in forever. Let’s say you start a guaranteed policy today. Then, in a year or two, your health improves, or you discover you actually qualify for a simplified no-medical plan. Great! You can cancel your guaranteed policy and replace it with a more cost-effective one.

That’s why working with a broker like TermCanada matters. We don’t just sell you a policy and disappear. We stay with you. As your life changes, we adapt your coverage to match your situation.

Accidental Death - Are You Covered?

One important distinction to understand about guaranteed issue life insurance is accidental death.

If you die of natural causes during the two year waiting period your beneficiary won’t receive their payout.

That said, if you die in a qualifying accident, they receive the full death benefit immediately. This means that if someone passes away in a car crash or another unexpected accident within those first two years, their beneficiaries receive the full payout, not just a return of premiums.

This detail offers many clients peace of mind, knowing that their family is protected from the financial shock of a sudden accidental loss.

Note: Assuris is an independent, not for profit, industry-funded compensation organization founded in 1990. Our mission is to protect Canadian policyholders if their life and health insurance company fails.

Final Thoughts from Chris Funnell at TermCanada

Guaranteed life insurance may not be a coverage option for many Canadians, but it’s an important topic. It protects a vulnerable part of the population. Offering a chance to provide financial assistance when your family needs it most.

If you’re not sure where to start, or whether this is even the right move, we’re here to help. At TermCanada, we know all the ins and outs of these policies and can find you the most comprehensive coverage for the best price.

Ready to apply? Contact a life insurance broker at TermCanada for help finding the right guaranteed policy.