If you are looking for “A1C target diabetes Canada” on the web, it’s likely you or a loved one are paying attention to your blood sugar because you are a diabetic or have been warned you may be on the edge.

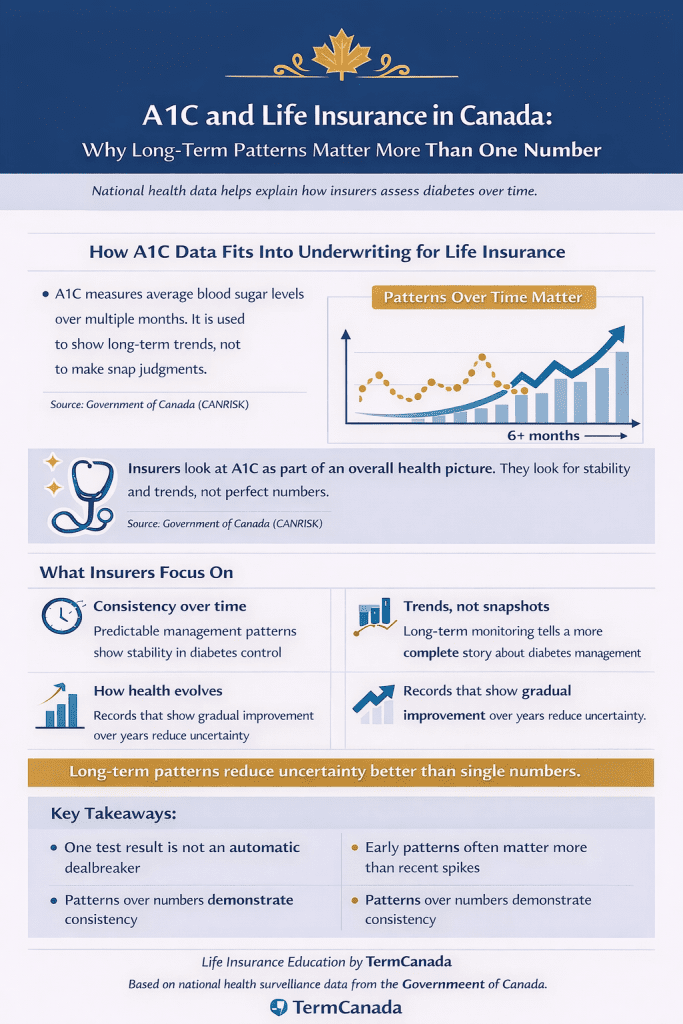

For many Canadians living with diabetes, life insurance can feel intimidating because of numbers. Blood sugar readings, also known as A1C results, and other medical metrics are often discussed as if they were rigid thresholds that determine eligibility. It’s easy to assume that one test result could outweigh everything else.

In reality, life insurance underwriting in Canada doesn’t work that way.

Insurers are not looking for perfection, and they are not making decisions based on a single data point.

Instead, they focus on long-term patterns, consistency, and your broader health picture. Understanding how A1C and blood sugar information is interpreted can help remove unnecessary fear and clarify what actually matters during the insurance process.

An A1c test is a blood test that checks your average blood sugar level over the past 2 to 3 months. This test also is called a glycohemoglobin test or a hemoglobin A1c test. The A1c test is one of the tests used to diagnose prediabetes and diabetes. If you have diabetes, this test is done to check how well your diabetes has been managed over the past 2 to 3 months. Your doctor can use this information to adjust your treatment, if needed.

What Is A1c?, MyHealth.Alberta.ca Tweet

Why A1C Comes Up in Life Insurance Conversations

Many people searching for A1C target diabetes Canada are looking for clear answers about what the numbers mean and how they are used. A1C readings help healthcare providers monitor trends rather than day-to-day fluctuations.

Life insurance companies reference A1C for a similar reason… context. They are not setting treatment goals or evaluating whether someone is meeting medical guidelines. Instead, A1C offers a window into how blood sugar levels behave over time.

From an underwriting perspective, A1C is not a verdict. It is one piece of historical information that helps insurers understand stability, predictability, and long-term trends.

This emphasis on long-term trends is one of the reasons diabetes is not assessed in isolation. Understanding how insurers view stability over time helps explain the life insurance options for diabetics in Canada and why eligibility decisions are contextualized rather than based on a single result.

While A1C provides useful info, insurers often place greater emphasis on whether diabetes-related complications are present. In underwriting, factors such as microvascular complications, including conditions like retinopathy or neuropathy, may influence eligibility more than the A1C number itself, because they reflect long-term outcomes rather than short-term control.

A1C Targets in Canada and Insurance Underwriting

Clinical diabetes Canada A1C targets are designed to support medical decision-making. These guidelines help clinicians manage care and reduce the risk of complications. Insurance underwriting, however, does not apply these targets as approval or denial thresholds.

While Diabetes Canada guidelines A1C target ranges are useful in healthcare settings, insurers rely on actuarial data rather than clinical rules. Actuarial models are built from population-level outcomes observed over long periods. Because of this, underwriting decisions are rarely tied to whether someone falls above or below a specific guideline at a single point.

What matters far more is how results behave over months and years. Consistency and long-term stability provide far more insight than one isolated number.

A1C Target Diabetes Canada: Patterns Matter More Than Individual Results

Blood sugar levels naturally fluctuate. Stress, illness, changes in routine, travel, or temporary lifestyle shifts can all affect short-term readings. Because variation is expected, insurers place very little weight on individual results taken in isolation.

Underwriting assessments are designed to look for trends. Stable patterns, gradual changes, and predictable management over time help insurers reduce uncertainty. A single elevated or unexpected result rarely tells a meaningful story on its own.

This is why insurers often review health information spanning multiple years rather than focusing on a single appointment or test.

How Food and Daily Habits Fit Into the Picture

When people Google A1C target diabetes Canada, food choices often come up alongside lab results.

Daily habits, including nutrition, are understood as part of broader long-term patterns. Consistent routines tend to support stable trends over time, which is what underwriting models are designed to assess.

Insurers are not reviewing grocery lists or New Year’s resolutions. They rely on medical records and historical data that reflect overall consistency rather than temporary adjustments. Long-standing patterns matter far more than recent shifts when viewed alongside other health indicators.

Underwriting assessments are designed to look for trends. Stable patterns, gradual changes, and predictable management over time help insurers reduce uncertainty. A single elevated or unexpected result rarely tells a meaningful story on its own.

Blood Sugar Readings Beyond A1C Target Diabetes Canada

Daily blood sugar readings play an important role in personal diabetes management, but they are not typically evaluated individually during life insurance underwriting. Like A1C, these readings are interpreted in context.

From an underwriting standpoint, the focus is on whether blood sugar control appears predictable and stable over time. Short-term variation is expected. Long-term volatility is more relevant than any single reading.

This approach reflects how diabetes is understood at a population level, using large datasets rather than isolated snapshots.

💡Another factor insurers often consider alongside A1C trends is the age at which diabetes was diagnosed. From an underwriting perspective, a later-age diagnosis… for example, diabetes identified after age 50, can sometimes be viewed differently than an early-age diagnosis, regardless of current A1C results. This is because longer exposure over time can influence how insurers assess long-term risk patterns.

How BMI Is Interpreted Alongside Diabetes

Body Mass Index (BMI) is another metric that often causes concern during the insurance process. Like A1C and blood sugar readings, BMI is not treated as a pass-fail requirement.

Insurers use BMI as anindicator rather than a standalone decision factor. It is considered alongside overall health history, duration of diabetes, consistency of management, and the presence or absence of complications.

Once again, the emphasis is on patterns rather than labels. No single measurement overrides long-term stability.

A1C Target Diabetes Canada: Why Time Often Works in Your Favour

One of the most reassuring aspects of life insurance underwriting for people with diabetes is that time often reduces uncertainty. Longer histories of consistent management provide more data, which allows insurers to make more individualized assessments.

This is why underwriting decisions are rarely about achieving a specific number. They are about understanding how health indicators behave over the long term.

Common Misunderstandings About Numbers and Insurance

Many of the fears surrounding diabetes and life insurance stem from misunderstandings about how underwriting works. It’s common to assume that one high reading or one recent result defines everything.

In reality, insurers expect variation.

Understanding this distinction can make the insurance process feel far less intimidating and far more predictable.

Why Underwriting Is Structured This Way

Life insurance underwriting is based on actuarial science, which is the study of long-term outcomes across large populations. Because diabetes is common in Canada and is extensively tracked in national health data, insurers have decades of evidence to draw on.

This allows underwriting models to be nuanced and data-driven rather than reactive.

Connections to Life Insurance Options

Understanding how blood sugar and A1C data are interpreted helps explain why multiple life insurance options for diabetics in Canada exist. Eligibility pathways vary depending on individual circumstances, but they are shaped by long-term data rather than isolated results.

For many Canadians, this means coverage options are more flexible than expected, particularly when health patterns show consistency.

A1C Target Diabetes Canada: Why Education Reduces Anxiety

At TermCanada, we understand that much of the anxiety around diabetes and life insurance comes from uncertainty. When people believe that one number determines everything, the process can feel unpredictable or unfair.

Education shifts the focus from fear to facts when you are researching A1C target diabetes Canada. It reframes numbers as context rather than judgments and helps people understand how underwriting actually works.